Share Price Target 2023 2024 2025 2030

Rattan Power Share Price Target 2025

India’s one of the best private sectors of power generation companies. Rattan Power Limited is founded in 2017 and its headquarters is based in India, the CEO of the Company is Rajiv Ratan and the Independent Director of this company is Sanjeev Chhikara the managing director is vibhav Agarwal.

The key points of Rattan Power Limited (Helps You To explain for future price Prediction)

- The total investment of Ratan Power Limited is about Rs.18,615 crores in Dollars it cost about $2.5 billion dollars

- The land of our Rattan Power Limited is spread over 2,400 acres which produces over 23.6 billion units of electricity annually.

- The total electricity produced in 2,700 megawatts of power plants.

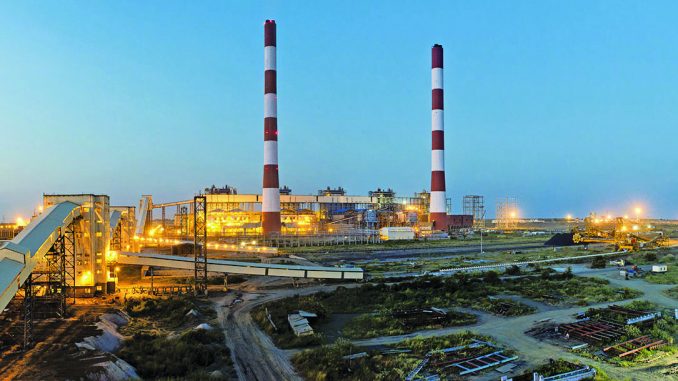

- The Thermal Power Plants are installed in Amravati and Nashik about the partition of 50-50 means about the 1,350-megawatt plant is based in Nashik and the 1350-megawatt plant based in Amravati they both located in Maharashtra, India

Amravati power plant

- They operate their own Railway Lines between walgaon to Amravati power plant to supply coal to produce power supply

- The exact location of the Amravati thermal power plant is located in Nandgaonpeth, 13 km away from Amravati City, Maharashtra, India.

Nashik thermal power plant

- It is located in Sinnar 40 km away from Nasik city in Maharashtra, India

- The transmission line from the Sinnar plant to Bhubaneswar is around 57 km long.

Rattan Power Share Price Target 2023 2024 2025 2030

| The Year 2023 | Rs 5.35 |

| The Year 2024 | Rs 7.30 |

| The Year 2025 | Rs 9.15 |

| The Year 2030 | Rs 12.50 |

This is not financial advice. DYOR (Do your own research) before investing in stocks. We are not responsible for your losses. It is just a price prediction. That is how this stock moves according to the upcoming years and what changes the company will decide to grow the company as usual.

Quarterly financials

| (INR) | Mar 2022 | Y/Y |

| Revenue | 823.23Cr | 4.51% |

| Net income | -310.43Cr | 889.47% |

| Diluted EPS | -0.57 | 812.5% |

| Net profit margin | -37.71% | 926.97% |

Is Rattan Power Limited Share good stock?

- If you are interested in acquiring Rattan power limited share then buy it for the long term with proper stop loss and tight stop loss because if you really want to make some good amount of profit from this stock then you have to hold it for a long period of time at least 15 to 20 years.

- Long-term holding is way too good instead of a short period of time. The production of electricity supply will improve in upcoming years.

- Companies like Rattan Power Limited – Will change their productivity from coal to renewable energies. Because it is relatively better for the environment.

- For future prediction, is it good stock because of changes in productivity from coal to renewable energy. Investment in this company will give you huge profits in long term. So do your own research before taking any actions against the market.

- Mark your important level on the charts of Rattan Power. To make RCA (Rupee Cost Average) on your levels with good stop loss.

This is not financial advice. DYOR (Do your own research) before investing in stocks.

Many circumstances come and disappear, just DYOR and invest where you can see the company’s future. It depends on you, and how you do the research.

Follow Upcoming Khabar for more info

1 thought on “Rattan Power Share Price Target 2025”